Vitamin - Mineral Premixes Market

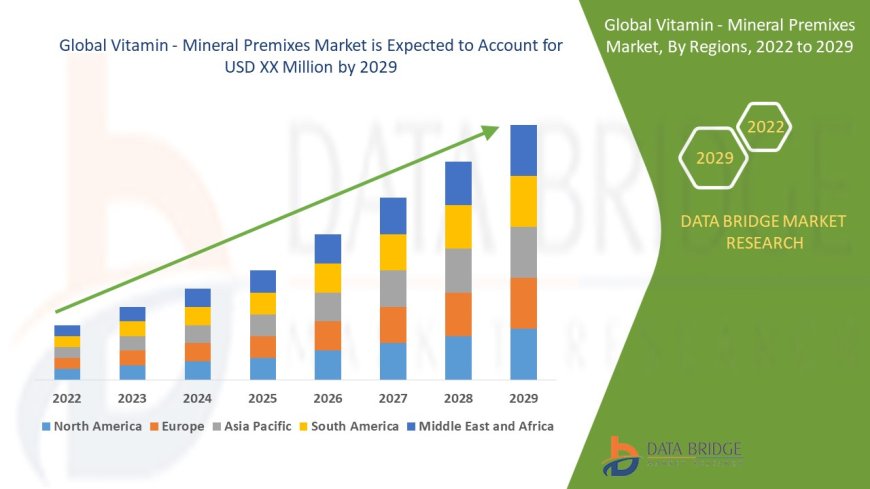

Data Bridge Market Research analyses that the global vitamin - mineral premixes is growing at a CAGR of 5.7% in the forecast period of 2022 to 2029.

Vitamin and mineral premixes are specialized blends of essential micronutrients designed to enhance the nutritional value of food, beverages, feed, and pharmaceuticals. These premixes are widely used to fortify products with precise concentrations of vitamins and minerals to meet specific dietary requirements and regulatory standards. The growing awareness of health and wellness, rising prevalence of micronutrient deficiencies, and demand for fortified foods and feeds are key drivers in the global vitamin - mineral premixes market.

Premixes offer convenience and cost-effectiveness by combining multiple micronutrients in a single, homogeneous blend. They are customized for different applications across industries such as food and beverage, animal nutrition, healthcare, personal care, and pharmaceuticals. The precision in formulation ensures consistent quality, safety, and efficacy in the final products.

As global populations grow more health-conscious and the burden of malnutrition remains prevalent in both developing and developed countries, vitamin and mineral premixes play a vital role in promoting public health, improving livestock productivity, and enhancing product shelf life and stability.

The Evolution

The evolution of the vitamin - mineral premixes market can be traced back to the early 20th century when scientific understanding of micronutrients began to develop. Initially, vitamins and minerals were added individually to food and feed products. Manufacturers faced challenges in maintaining consistency, achieving uniform distribution, and preventing interactions between components.

In the mid-1900s, the concept of premixes emerged as a solution to these challenges. The food fortification movement gained momentum in the United States and Europe with the addition of iodine to salt, vitamin D to milk, and iron to flour. These early fortification programs laid the foundation for the commercial premix industry.

By the 1970s, premixes were being used in animal feed to improve growth rates, reproduction, and disease resistance in livestock and poultry. The livestock sector became a significant consumer of premix products, particularly in regions focused on industrial-scale meat and dairy production.

The 1980s and 1990s witnessed rapid advancements in premix formulation technology. Microencapsulation, chelation, and spray-drying techniques enabled better bioavailability, stability, and masking of undesirable tastes and odors. The pharmaceutical and nutraceutical industries also began using premixes in tablets, capsules, and powder formulations.

During the 2000s, the functional food and beverage sector experienced substantial growth, driving demand for premixes that support immunity, bone health, cognitive function, and energy. Consumer preferences for personalized nutrition, clean-label products, and plant-based alternatives led to greater customization and innovation in premix offerings.

Today, premix manufacturers operate in a highly competitive global market. They offer tailored solutions for specific consumer segments, geographic markets, and regulatory frameworks. Advanced analytics, AI-driven formulation, and real-time quality monitoring have further optimized premix production and supply chain efficiency.

Market Trends

The vitamin - mineral premixes market is shaped by several ongoing trends. One of the dominant trends is the increasing demand for fortified food and beverages. Consumers are seeking convenient products that deliver essential nutrients without compromising taste, texture, or shelf life.

Personalized nutrition is influencing premix formulations. Companies are developing customized blends based on age, gender, health status, and dietary preferences. DNA-based nutrition and lifestyle diagnostics are helping tailor premixes to individual needs.

There is a strong preference for clean-label and organic ingredients. Consumers want transparency in sourcing and formulation. Premix manufacturers are replacing synthetic additives with natural alternatives and using plant-based sources of vitamins and minerals.

Functional beverages and health drinks are becoming popular delivery formats for vitamin and mineral premixes. Sports nutrition, energy drinks, and herbal-infused water are key segments driving innovation in powder and liquid premix forms.

In animal nutrition, there is a shift towards performance-based premixes. Farmers and feed manufacturers are using data analytics to monitor livestock health and optimize premix content for growth, reproduction, and disease resistance.

Sustainability is gaining importance. Companies are minimizing environmental impact by using eco-friendly packaging, reducing carbon footprints in manufacturing, and sourcing raw materials responsibly.

The rise of veganism and vegetarianism is prompting a demand for non-animal-derived vitamins and minerals. Manufacturers are focusing on vegan-friendly formulations free from gelatin, dairy, and other animal-based ingredients.

Pharmaceutical and nutraceutical sectors are integrating premixes in over-the-counter (OTC) products and clinical nutrition. Immune support, bone health, joint health, and cognitive enhancement are top categories where premixes are heavily used.

E-commerce and direct-to-consumer (DTC) distribution models are boosting the accessibility of premix-based products. Companies are offering subscription models for multivitamin powders, customized drink mixes, and dietary supplements.

Regulatory compliance and quality assurance remain key drivers in product development. Manufacturers are aligning with global standards from organizations such as the FDA, EFSA, WHO, and Codex Alimentarius.

Challenges

The vitamin - mineral premixes market faces a number of challenges. Formulation complexity is a primary concern. Vitamins and minerals interact with each other, and certain combinations can lead to instability, degradation, or reduced bioavailability.

Cost fluctuations in raw materials, especially for rare or natural sources, affect pricing and profitability. Vitamin C, Vitamin D, and mineral salts like zinc and selenium are subject to market volatility due to supply chain disruptions and geopolitical factors.

Stringent regulations across different countries complicate product formulation and labeling. Manufacturers must navigate varying permissible limits, approved claims, and fortification mandates, which may differ significantly by region.

Product consistency and quality control are critical. Even slight variations in micronutrient concentration can impact efficacy and safety. Ensuring homogeneity, minimizing cross-contamination, and maintaining batch-to-batch reproducibility require robust manufacturing systems.

Shelf life stability poses challenges. Some vitamins are highly sensitive to light, heat, moisture, and oxygen. Packaging innovations and stabilizing agents are required to ensure product integrity during storage and transportation.

Consumer skepticism about synthetic additives and supplement overuse can hinder adoption. Misinformation and lack of awareness about the benefits and risks of micronutrient supplementation create barriers to acceptance.

In animal feed applications, regulatory restrictions on antibiotic growth promoters have increased reliance on nutritional alternatives. However, ensuring consistent results from vitamin - mineral premixes requires precise formulation and monitoring, which may not be feasible for small-scale farmers.

Adulteration and counterfeit products remain a concern, especially in unregulated markets. Substandard or mislabeled premixes can undermine brand trust and pose health risks.

Logistical and supply chain complexities impact delivery timelines and cost efficiencies. Sourcing ingredients from multiple countries and meeting just-in-time manufacturing demands require streamlined coordination.

The need for specialized workforce and technical expertise is growing. R&D professionals, food technologists, and regulatory affairs experts are essential for successful product development and market entry.

Market Scope

The vitamin - mineral premixes market encompasses applications across several major sectors. These include food and beverages, dietary supplements, pharmaceuticals, animal feed, and personal care. Each sector has unique requirements in terms of formulation, quality, and functionality.

In the food and beverage industry, premixes are used in baked goods, dairy products, breakfast cereals, infant nutrition, juices, and meal replacements. Fortification with iron, folic acid, Vitamin A, and iodine is common in staple foods in developing regions.

Dietary supplements represent a fast-growing application area. Premixes are used in tablets, capsules, powders, gummies, and effervescent formulations. Target groups include children, pregnant women, elderly populations, athletes, and immune-compromised individuals.

Pharmaceutical applications involve premixes for oral rehydration salts, enteral nutrition, and prescription-based formulations for managing deficiencies, chronic diseases, and recovery. Hospitals and clinical care providers are key end-users.

Animal nutrition is a major market segment. Premixes are incorporated into feed for poultry, swine, ruminants, aquaculture, and pets. They support optimal growth, reproduction, immunity, and productivity. Custom blends are created for different species and life stages.

Personal care and cosmetics include skin creams, hair oils, and beauty supplements containing Vitamin E, biotin, zinc, and other micronutrients. Nutricosmetics, or ingestible beauty products, are gaining popularity in this space.

Premixes are distributed through B2B and B2C channels. In B2B, manufacturers supply blends directly to food companies, feed producers, pharmaceutical firms, and cosmetic brands. B2C involves retail and online sales of pre-formulated powders, sachets, and supplement kits.

Customization is a key feature of this market. Premix providers work closely with clients to develop tailored formulations that meet functional, sensory, and regulatory needs. Packaging, shelf life, solubility, and stability are considered during product design.

The market is global in scope. North America, Europe, and Asia-Pacific are major regions with strong demand for premixes. Latin America, Middle East, and Africa are emerging markets with high growth potential due to nutritional deficiencies and rising incomes.

Multinational companies and specialized contract manufacturers dominate the competitive landscape. They invest in R&D, strategic acquisitions, and partnerships to expand product portfolios and geographic presence.

Market Size and Factors Driving Growth

The global vitamin - mineral premixes market was valued at approximately USD 8.2 billion in 2024 and is projected to reach USD 12.5 billion by 2030, growing at a CAGR of 7.2% during the forecast period. The market is witnessing robust growth due to several converging factors.

Rising health awareness among consumers is driving demand for fortified foods and supplements. Concerns about immunity, aging, stress, and lifestyle diseases are prompting people to seek nutritional solutions.

Micronutrient deficiencies, also known as hidden hunger, affect billions of people globally. Government-led fortification programs and public health campaigns are promoting the use of premixes in staple foods to combat anemia, rickets, and birth defects.

Urbanization and changing dietary patterns are increasing reliance on processed foods. Premixes help restore or enhance the nutritional value lost during food processing, ensuring compliance with nutritional guidelines.

Growth in the middle-class population and disposable incomes, especially in Asia-Pacific and Africa, supports higher spending on nutrition-enhanced food, beverages, and supplements.

Expanding animal husbandry and aquaculture industries require optimized feed solutions. Premixes improve feed efficiency, health outcomes, and product quality in meat, milk, eggs, and fish production.

Advancements in formulation technologies are enabling the creation of more effective, palatable, and stable premixes. These innovations are improving user experience and widening consumer appeal.

The COVID-19 pandemic highlighted the importance of nutritional immunity. Demand surged for products containing Vitamins C, D, Zinc, and Selenium, creating long-term shifts in consumer behavior and industry focus.

Supportive regulatory frameworks and mandates for fortification in developing countries have created favorable conditions for premix market growth. Governments are partnering with private companies to deliver cost-effective, nutritionally fortified foods.

Globalization and consolidation in the food and nutrition industries are enabling wider access to premixes through improved distribution networks and economies of scale.

Investments in research and development are expanding the functional benefits of premixes. Emerging areas include gut health, cognitive function, metabolic health, and personalized wellness, driving innovation in product offerings.

Source: https://www.databridgemarketresearch.com/reports/global-vitamin-mineral-premixes-market

Conclusion

The vitamin - mineral premixes market is a dynamic and rapidly growing sector driven by rising health awareness, nutritional deficiencies, functional food trends, and advances in formulation technologies. Premixes offer a convenient, efficient, and cost-effective way to deliver essential micronutrients across a wide range of applications.

From food and beverages to animal nutrition and pharmaceuticals, premixes play a critical role in improving public health, enhancing product quality, and supporting sustainable development goals. The market is global in reach, diverse in scope, and rich in opportunities for innovation and expansion.

Despite challenges such as formulation complexity, regulatory hurdles, and supply chain disruptions, the outlook remains positive. Key players are investing in customization, clean-label solutions, and digital tools to meet evolving consumer needs and regulatory requirements.

As the world continues to prioritize health, wellness, and sustainability, the demand for high-quality, scientifically formulated vitamin and mineral premixes will continue to rise. Stakeholders across the value chain must collaborate to ensure accessibility, affordability, and efficacy of these vital nutritional solutions.