Understanding the Taxation Rate in USA: What You Need to Know in 2025

Taxes are an inevitable part of life, especially in a country like the United States, where the tax code is complex, multi-layered, and ever-changing. Whether you're an individual employee, self-employed professional, or business owner, understanding the taxation rate in USA is essential for making informed financial decisions and staying compliant with the IRS.

In this blog, well break down the U.S. tax system, federal and state rates, key changes in 2025, and how professional tax services can help you avoid costly mistakes while maximizing deductions.

What Is the Taxation Rate in USA?

The term "taxation rate" refers to the percentage of income or value that is paid as tax to the government. In the U.S., this isn't just one single rateit's a progressive system, meaning the more you earn, the higher percentage you typically pay.

There are multiple types of taxes in the USA, including:

-

Federal income tax

-

State income tax

-

Payroll tax (Social Security and Medicare)

-

Corporate tax

-

Capital gains tax

-

Self-employment tax

Each comes with its own set of brackets, rules, and exemptions.

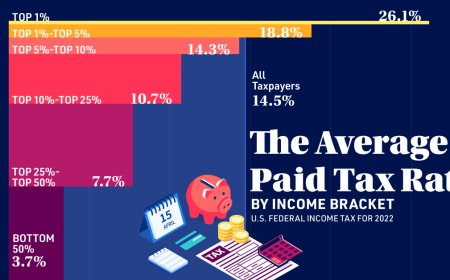

Federal Income Tax Rates in 2025

The federal income tax system in the U.S. is progressive and consists of seven tax brackets for most individual filers. While exact brackets may be adjusted annually for inflation, the 2025 rates (as proposed and expected) are approximately:

| Taxable Income (Single) | Tax Rate |

|---|---|

| Up to $11,600 | 10% |

| $11,601 $47,150 | 12% |

| $47,151 $100,525 | 22% |

| $100,526 $191,950 | 24% |

| $191,951 $243,725 | 32% |

| $243,726 $609,350 | 35% |

| Over $609,350 | 37% |

The same bracket applies to married couples filing jointly, with different thresholds.

Keep in mind:

-

These rates apply to taxable income, not gross income.

-

Deductions like standard deduction ($14,600 for single in 2025) reduce your taxable base.

State Income Taxes: Varies by Location

In addition to federal taxes, most U.S. states levy their own state income taxes. Rates and structures vary:

-

Flat Tax States: e.g., Colorado (4.4%)

-

Progressive States: e.g., California (1%13.3%)

-

No Income Tax States: e.g., Florida, Texas, Washington

Your total tax burden depends on where you live and work. A resident in New York City, for example, may pay federal, state, and local income taxes, significantly affecting take-home pay.

This is where a tax expert becomes invaluableunderstanding the taxation rate in USA is more than just knowing numbers; it's about planning strategically across jurisdictions.

Other Key Tax Rates You Should Know

1. Capital Gains Tax

-

Short-term gains (held < 1 year): Taxed as ordinary income.

-

Long-term gains: 0%, 15%, or 20%, depending on income.

2. Self-Employment Tax

-

Total rate is 15.3% (12.4% for Social Security + 2.9% for Medicare).

-

This applies to freelancers, gig workers, and sole proprietors.

3. Corporate Tax Rate

-

Flat rate of 21% for C-corporations (as of 2025).

-

S-corps and LLCs may pass through income to owners and pay individual rates.

4. Payroll Taxes

-

Social Security: 6.2% (employer) + 6.2% (employee)

-

Medicare: 1.45% each side; 0.9% additional Medicare tax on higher incomes.

How Tax Brackets Work (And Why They Confuse People)

A common misconception is that moving into a higher bracket means all your income is taxed at that rate. Thats not true.

Example:

If you earn $60,000:

-

The first $11,600 is taxed at 10%

-

The next $35,550 is taxed at 12%

-

The remaining $12,850 is taxed at 22%

This means your effective tax rate is much lower than your marginal rate. Understanding this can help with smarter financial planning and better decision-making.

What Affects Your Tax Rate?

Here are several factors that influence how much tax you owe in the U.S.:

-

Filing status (single, married filing jointly, head of household)

-

Number of dependents

-

Deductions (standard or itemized)

-

Credits (Child Tax Credit, Education Credit, etc.)

-

Retirement contributions (IRA, 401(k), HSA)

-

Health insurance coverage

-

Capital gains or losses

-

Business income and expenses

Thats a lot to track. Thats why having a professional review your financial picture is essential for proper tax planning and filing.

Why You Shouldnt Guess the Taxation Rate

Google can show you the brackets, but it wont help you:

-

Decide between standard or itemized deductions

-

Understand if you're eligible for credits

-

Structure business expenses to lower tax liability

-

Avoid double taxation if you work across states

Thats why many individuals and businesses choose expert tax services USA from firms like Pro Tax Return to ensure full compliance and peace of mind.

Tax Planning Tips for 2025

Here are some practical ways to reduce your tax bill:

? Contribute to a retirement plan (401(k), IRA)

? Use HSA or FSA for medical expenses

? Harvest investment losses to offset capital gains

? Track deductible expenses throughout the year

? Consider forming an LLC or S-Corp for self-employed income

? Keep accurate records of income, expenses, and receipts

Working with a tax consultant allows you to apply these tactics properly and avoid red flags.

Why Choose Pro Tax Return?

At Pro Tax Return, we dont just file your taxeswe help you plan smarter, save more, and protect your wealth.

Heres what sets us apart:

-

? Experienced CPAs and EAs

-

? Multi-state and federal filing expertise

-

? Small business and self-employment specialists

-

? Fast, secure, and fully digital process

-

? Personalized tax strategies based on your life goals

Whether you're an individual filer, freelancer, or business owner, our team is here to simplify every step of your tax journey.

Final Thoughts: Know the Rates, Win the Refund

The taxation rate in USA can seem complicatedbut it doesnt have to be. With the right knowledge and support, you can minimize what you owe, stay compliant, and plan for a more financially secure future.

? Ready to take control of your taxes in 2025? Partner with Pro Tax Return and let our experts guide you through it all with confidence and clarity.

? Learn more about our expert tax services USA and schedule your consultation today.